In October, Fraser Valley's housing market experienced a notable upswing in buyer activity, with residential sales increasing for the first time in five months. This uptick comes on the heels of a significant interest rate cut by the Bank of Canada, which has spurred buyer interest and revived sales.

Market Overview

Sales Activity: The Fraser Valley Real Estate Board (FVREB) reported 1,330 sales in October, up 35% from September and 37% year-over-year.

New Listings: New listings fell by 5% from September to 3,194, yet remain 26% higher than last year.

Total Inventory: Active listings reached 8,799, slightly lower than September but 34% higher than October 2023.

Property Types and Prices

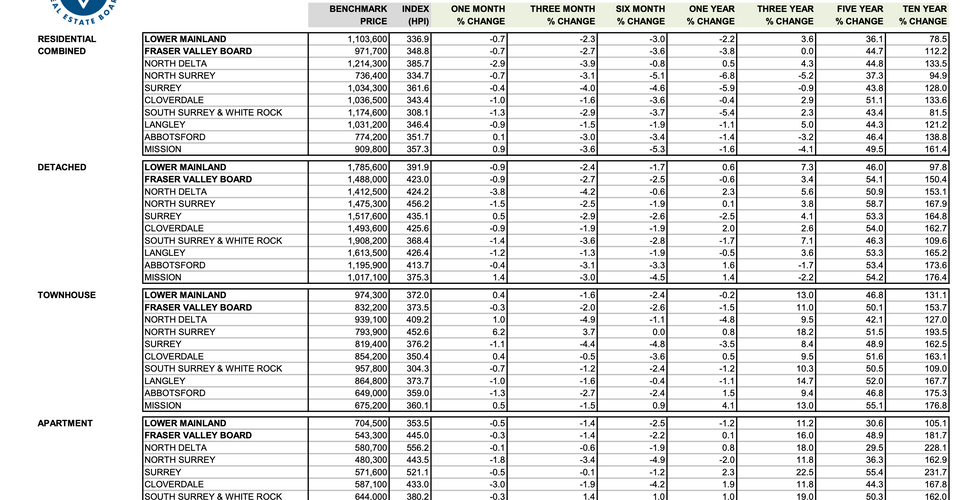

Single-Family Detached: Benchmark price at $1,488,000, down 0.9% from September and 0.6% year-over-year.

Townhomes: Benchmark price at $832,200, a small 0.3% decline from September and 1.4% lower year-over-year.

Apartments: Benchmark price at $543,300, showing stability with only a 0.3% monthly dip and a slight 0.1% increase year-over-year.

Source: Fraser Valley Real Estate Board

The Fraser Valley remains balanced, with a 15% sales-to-active listings ratio. Detached homes are taking an average of 34 days to sell, while condos and townhomes average around 32 and 29 days, respectively. This balanced state, combined with steady interest rate cuts, suggests that buyer confidence may be on the rise. While inventory remains sufficient, the market could shift if rates continue to drop, attracting more buyers into the market.

As we approach the year-end, potential further rate cuts could further stimulate activity, particularly in townhomes and condos. Both sellers and buyers will benefit from closely monitoring these developments to make strategic moves in this evolving landscape.

.png)

Comments